+44 1865 259200

South-South Exchange on Climate Finance Tracking

19 October 2022

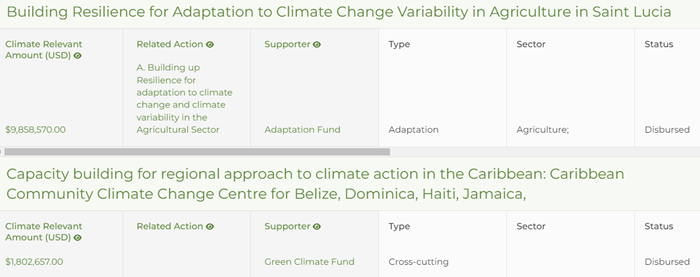

Justin Goodwin was invited to be on a panel at a South-South Exchange lead by Saint Lucia on climate finance tracking for low emission, climate resilient development. The sessions shared experiences and understanding of developing climate finance flows through the eyes and thoughts of a series of panellists. Discussion focused on why climate finance flows were important and their value in informing and mobilising investment in climate action. Justin was asked to demonstrate the MRV portal that Aether has been designing, building, and maintaining for Saint Lucia and its climate finance module with connected public facing website. He was asked for insights from Aether’s work on developing MRV and Transparency teams and tools with a range of countries. A write up of the questions and his answers are below.

Question 1: “How do climate finance tracking systems complement the broader objectives of MRV within the international reporting context?”

MRV/Transparency is an evidence communications exercise. The broad objectives of MRV/transparency are to make it easy to for decision makers to design, implement and track progress with climate action, to build trust and understanding and investor confidence and to provide regular input to the global assessment of progress and collaboration to implement the Paris Agreement objectives. Implementing action requires investment, which we also call “Climate Finance”. As MRV specialists we need to work with data, but more importantly we need to properly engage with stakeholders and find the data and build value in that data. Tracking climate finance data flows are critical for identifying needs and aligning solutions for effective climate action. In the context of the Paris Agreement, “climate action” is change management. It focuses on new activities to build resilience, minimise atmospheric concentrations of GHGs and, at the same time, make a positive difference to the wider environment and society (e.g. advance sustainable development).

In the details of MRV/Transparency development and capacity building, we seek to help decision makers understand:

- The significance and nature of the national, subnational and global challenges faced (risks, vulnerabilities, loss and damage, GHG emissions and loss of removals).

- The desired outcomes and targets required to achieve Paris Agreement goals as well as sustainable growth and development of nations with minimal impact on the environment.

- The pathways (policies, programmes, actions) to achieve outcomes, their financial investment needs, wider positive and negative impacts on society (gender, youth, indigenous people), the environment (nature and biodiversity) and the economy (jobs and quality of life).

- The current landscape of finance and investment available, needed, received and how to mobilise it.

- Other critical factors (gaps and needs) for implementation.

Effective MRV/Transparency development requires strong engagement with stakeholders, identifying and clarifying their roles and responsibilities and their needs. The MRV/Transparency system needs to understand the valued outputs that serve decision making and drive interest in the achievement of outcomes. It also needs to continuously improve its integration of better data, delivery of decision support services and become an increasingly trusted and transparent resource.

Nationally Determined Contributions are the focal point for climate action, the change management we need to implement, and the investment needed to achieve it. The NDCs identify action that is being or could be implemented to change the way we generate and use energy, travel, produce food and provide shelter and cooling. The NDCs can, and should, address both mitigation and adaptation outcomes and present financial investment plans needed. Provision of climate finance investment plans will need to include objectives and expected outcomes. Investors want to see a return on investment. This return will be a blend of financial and sustainable development outcomes and not purely financial. In many cases investors will need to be prepared to exchange some financial return for a tangible longer term benefit. All this means more complex cost-benefit metrics are needed, and policy proposals need to be blended with non-financial metrics on the benefits of actions implemented, challenges reduced, outcomes and positive wider impacts achieved.

To conclude, climate finance tracking is essential in bringing the theoretical options for change to implementation. Any change requires investment, and nothing will happen unless that investment is mobilised and its benefits tracked as part of the MRV/Transparency system.

Question 2: Can you discuss some of the reporting challenges of not having clear baselines on finance flows, investment plans and comparable criteria to track national climate finance across both public and private sectors?”

Baselines on financial flows include information on the financial investment in projects and programmes delivering change – resilience & low GHG atmospheres across public and private sector activities. Financial flows also include investment in leadership and evidence development activities (MRV/Transparency) designed to inform and engage stakeholders in delivering effective change – e.g. designing and implementing climate actions. How much? Where? Benefiting who? How? The challenges in understanding and reporting climate finance include:

- Unclear metrics and definitions, which are in the infancy, with limited systems and tools available to facilitate appropriate tagging and subdivision of data.

- A wide range of new stakeholders who are not familiar with transparency and tracking climate action and support. Therefore, critical data collection activities fall between the gaps and there is limited expertise to verify and quality assure the data and get it in a fit state for decision making.

- There is no standardisation in project outcome tracking and reporting and a lack of clarity on financial flows. Project information requires further standardisation on monitoring metrics as well as presentation of outcomes linking to financial, climate and sustainable development goals.

- There is limited knowledge of what is currently being achieved and information to model enhancing ambition through investment.

- Stakeholders are not engaged because they are not able to identify the problems to solve with investment.

Addressing these problems should be a clear focus for MRV/Transparency leadership and include the development of:

- Appropriate and complete data flows from a range of national and subnational, public and private data providers.

- Pools of expertise that understand the data and can communicate it to decision makers via reports, indicators and ad-hoc briefings.

- Appropriate systems and tools that facilitate data flow and expert and decision maker engagement.

- Engagement and communication strategies to fully engage data providers, experts and data users (decision makers) in the value-added data flows.

- Strong governance in the form of laws, terms of reference, contracts, data supply agreements, Memorandums of Understanding (MoUs) that ensure essential data flows, engagement of experts, development and maintenance of systems and tools and effective stakeholder engagement for data collection as well as strategy development and implementation.

These developments can be implemented easily and across convenient milestones for reporting and engagement. MRV/Transparency leads can build capability around a basic improvement plan, identified outputs, required datasets and a live list of stakeholders, their roles and their function within the MRV system. Emerging teams can build on the tools they have that fit the data provided. Ideally leaders develop this programme over a continual 3-5 year period so it encompasses a few phases of reporting and stakeholder update events.

If you want to talk about developing MRV/Transparency systems or find out more about the work we are doing with Saint Lucia and other country teams please get in touch with justin.goodwin@aether-uk.com.

News topics

Testimonial

Don't just take our word for it...

Contact us